boulder co sales tax return form

Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. If there are multiple accounts associated with your profile select the account you would like to enter a return for on the drop-down menu.

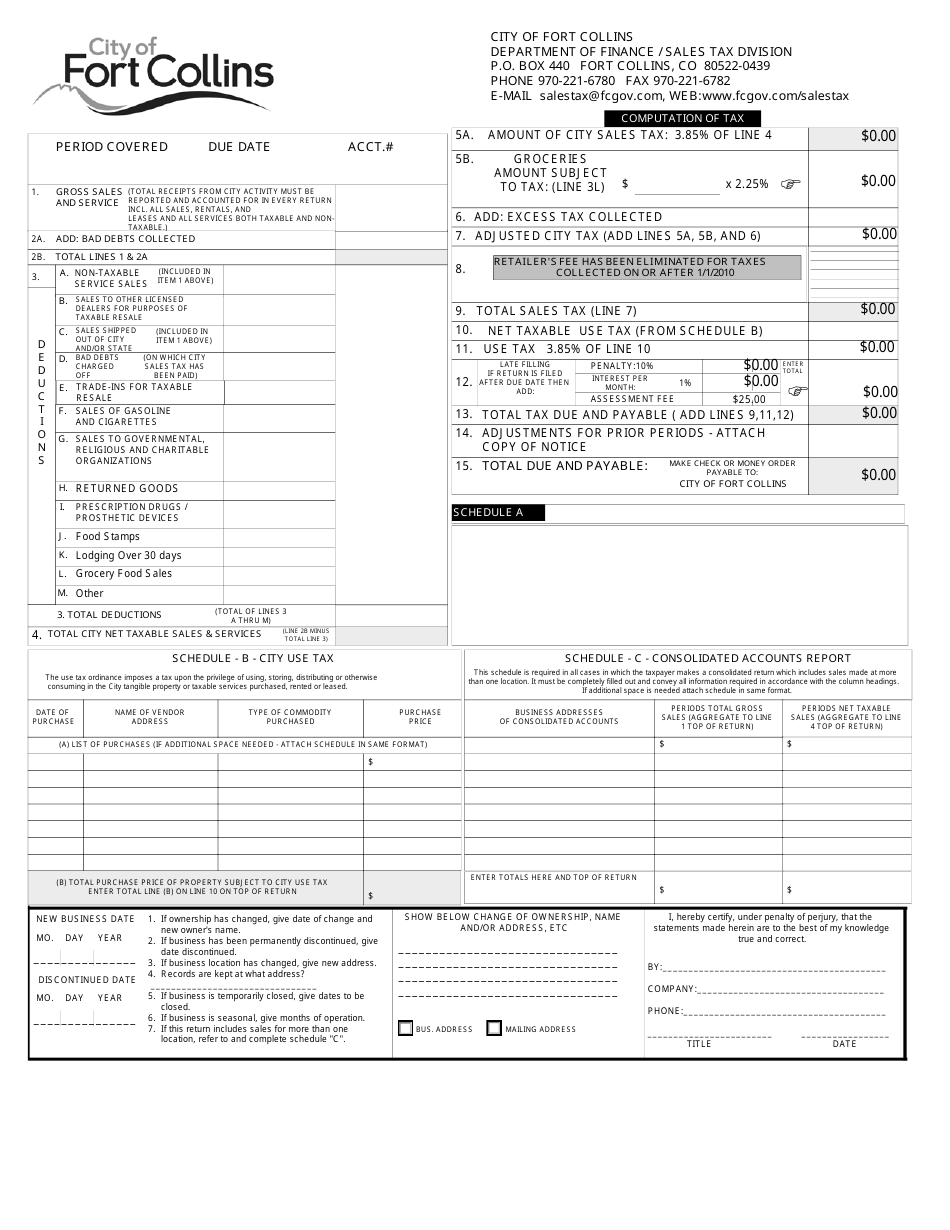

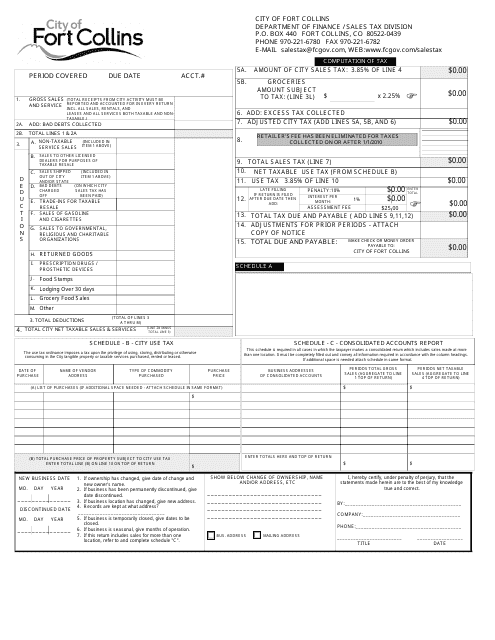

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Ad The Leading Online Publisher of Colorado-specific Legal Documents.

. For additional information regarding. Salesuse tax return due remit to. Lick File Returns 2.

Navigating the Boulder Online Tax System. The city of boulder requires all organizations and businesses coming into boulder for special events to obtain a city of boulder business license. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

Sales tax returns may be filed annually. This line 10 and enter the product on line 10. Get started with a boulder online tax 0 complete it in a few clicks and submit it securely.

If you need additional assistance. DR 0154 - Sales Tax Return. SALES TAX RETURN You must file this return even if line 15 is zero Note.

File a Tax Return 1. Broomfield CO 80038-0407 FILING PERIOD Required Returns not postmarked by the due date will be late. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

Filing frequency is determined by the amount of sales tax collected monthly. How to Apply for a Sales and Use Tax License. Subcontractor Affidavit Page 2 1777 BROADWAY PO.

All payments of Boulder County sales tax should be reported through CDORs Revenue Online or through CDORs printable forms found at CDORs website. About City of Boulders Sales and Use Tax. City of Boulder Sales Tax Form.

Boulder co sales tax return form. CR 0100AP - Business Application for Sales Tax Account. Get and Sign City of Boulder Sales Tax Form.

Valid returns are those. Annual returns are due January 20. DR 0100 - Retail Sales Tax Return Supplemental Instructions DR 0103 - State Service Fee Worksheet.

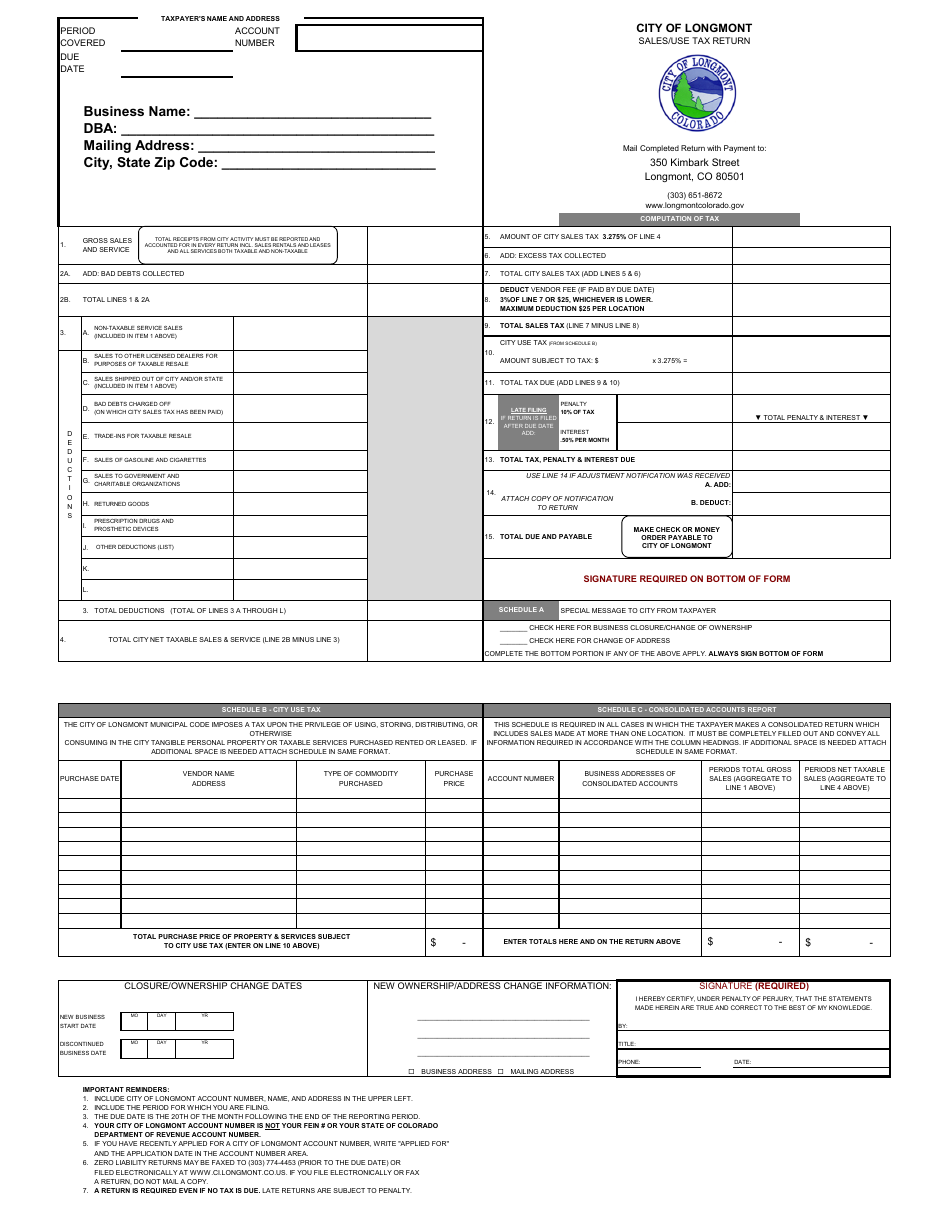

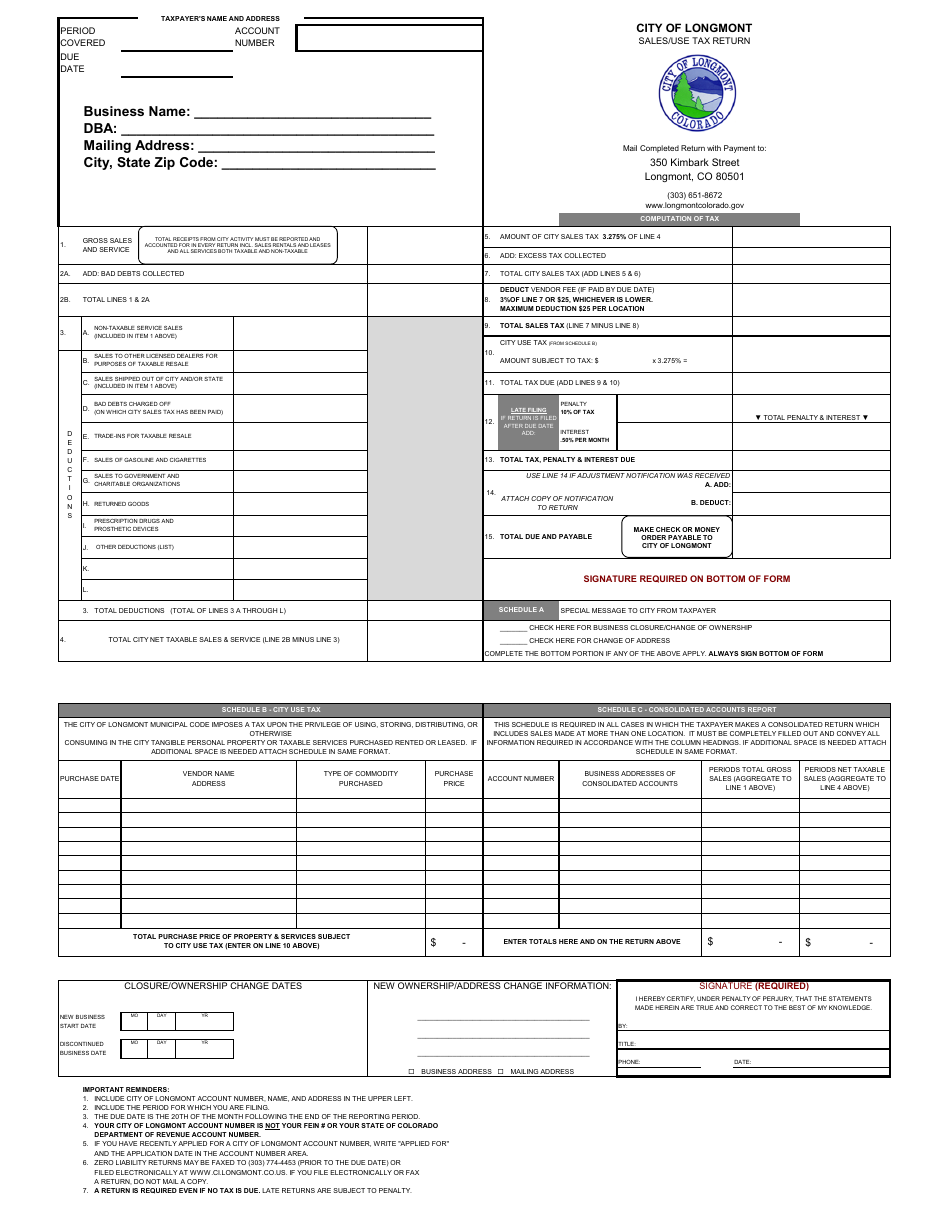

Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. Sales tax division period covered.

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and. Box 5885 denver co 80217-5885 tec. 303-384-8024 check here for business closure change of.

15 or less per month. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment. Ad We Search Hundreds Of Tax Deductions To Get You The Biggest Refund Possible Guaranteed.

Such credit may not exceed the Boulder use tax due. Paper Filing Taxpayers that choose to file tax returns by printing the form generated through Boulder Online Tax and personally deliver or mail with payment. BOX 791 BOULDER CO 80306 303441- 3288.

City of golden po. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Get Access to the Largest Online Library of Legal Forms for Any State.

Imposed sales or use taxes paid to other municipalities.

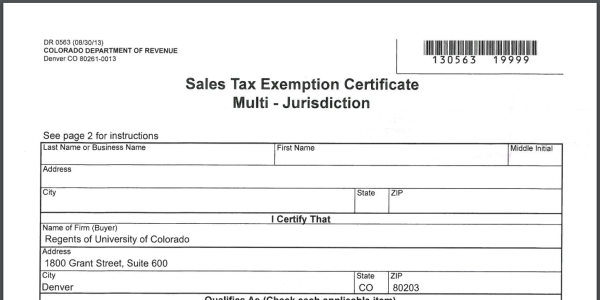

Sales Tax Campus Controller S Office University Of Colorado Boulder

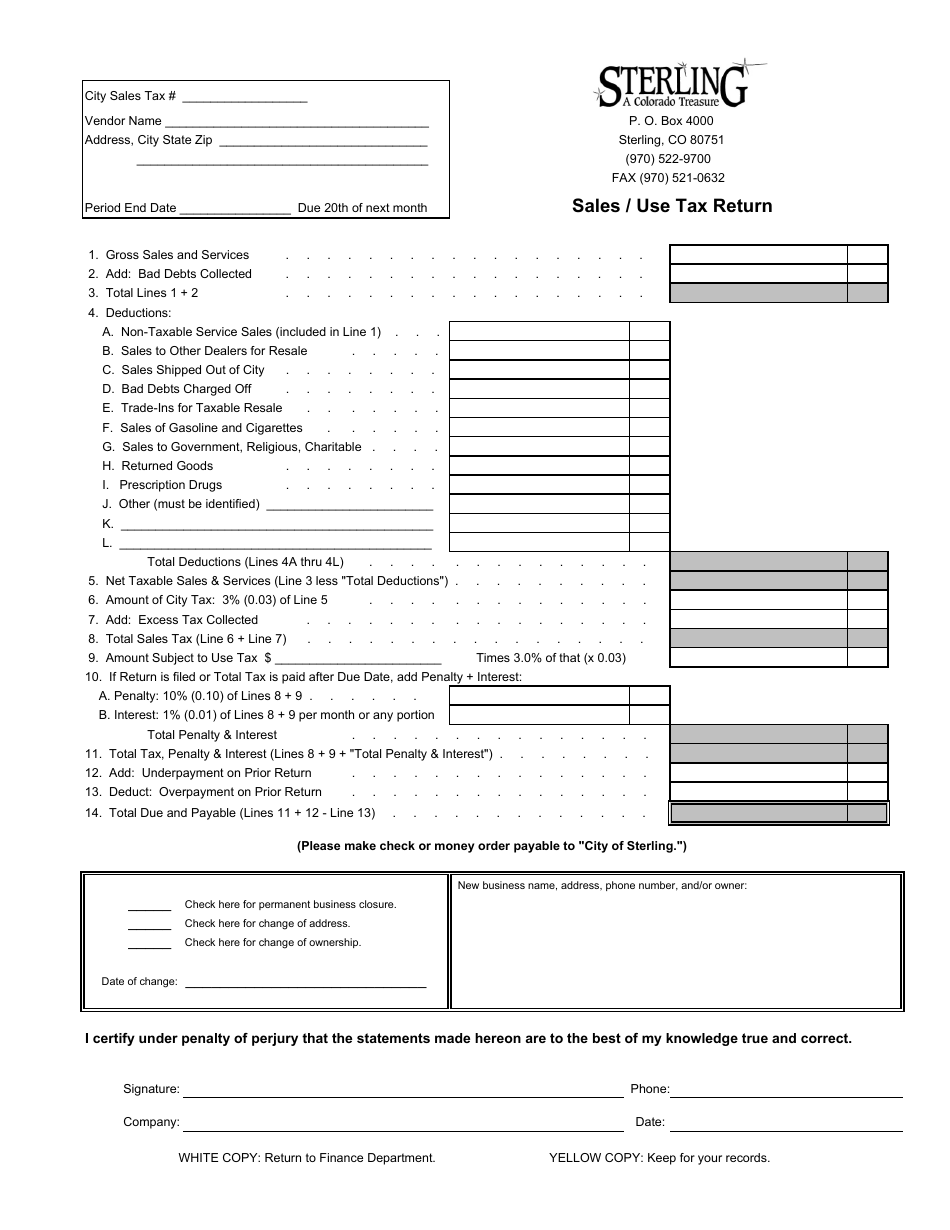

City Of Sterling Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Denver Sales Tax Online Fill Online Printable Fillable Blank Pdffiller

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

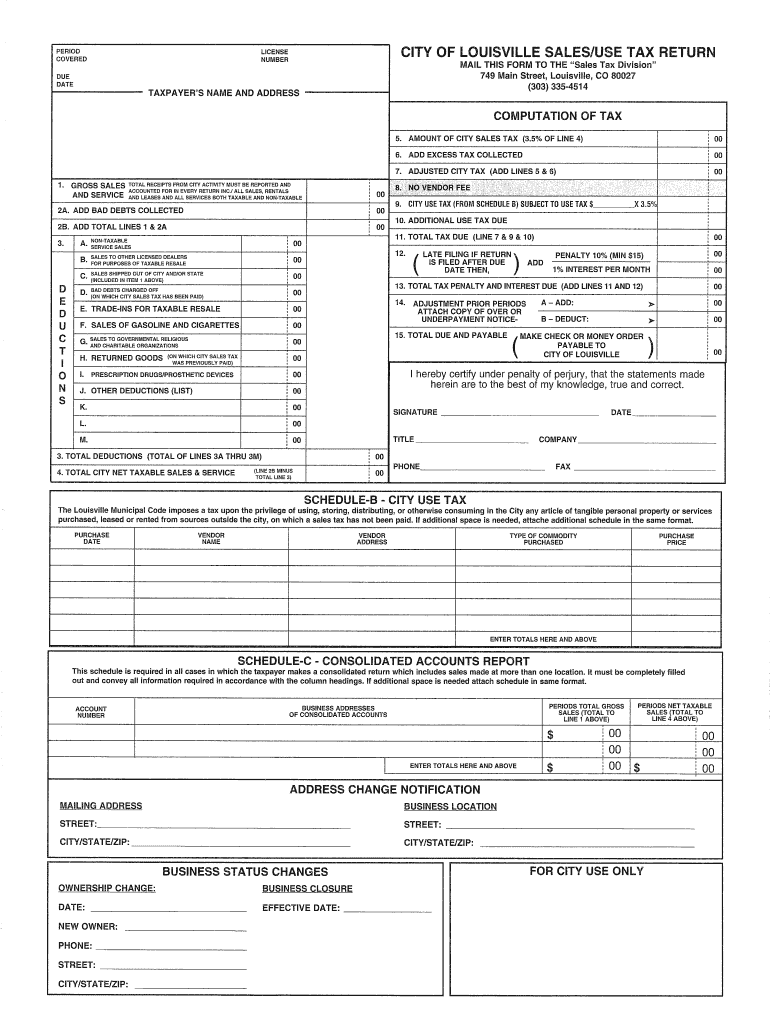

Co Sales Use Tax Return City Of Louisville Fill Out Tax Template Online Us Legal Forms

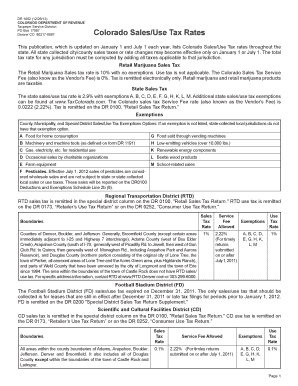

Colorado Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller